The City of Brampton is pushing for a more equitable funding model to address its growing infrastructure needs. Councillor Rowena Santos introduced a motion on January 29, 2025, inspired by a motion from the Town of Aurora’s Mayor, Tom Mrakas, calling on the federal and provincial governments to allocate a portion of the Land Transfer Tax (LTT) and Goods and Services Tax (GST) from property transactions to municipalities. Read the full motion here.

“Brampton is now Ontario’s 3rd largest municipality but has been chronically underfunded by other orders of government for decades. With a population of over 791,000 we only have one hospital with one emergency room. Our fast-growing community not only needs housing and health care, but also the water systems, roads, community centres, parks, fire, police, paramedics, and bylaw enforcement. It is unsustainable for municipalities to rely heavily on property taxes to fund infrastructure and services that come with growth. I am happy that our Brampton Council supported the motion which originated in Aurora, with now over 100 municipalities calling for our fair share of revenue from other orders of government. A fair allocation of the Land Transfer Tax and GST on property sales, will provide a sustainable and predictable source of revenue to help cover the costs of growth in municipalities like Brampton.”

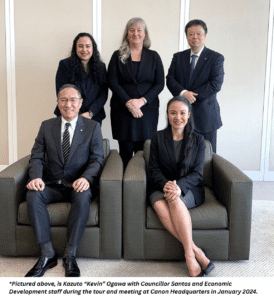

– Regional Councillor Rowena Santos, Brampton Wards 1 & 5

Municipalities are responsible for maintaining essential services such as roads, public transit, water systems, and emergency response. However, current revenue sources—primarily property taxes and user fees—are insufficient to meet rising infrastructure demands. Meanwhile, the Province of Ontario collects significant revenue from the LTT, and the federal government generates GST from property transactions, with no direct redistribution to municipalities.

Brampton, the third-largest city in Ontario and second in the Greater Toronto and Hamilton Area (GTHA), is experiencing rapid growth, particularly with the mandated expansion of Additional Residential Units (ARUs). While ARUs contribute to housing supply, they also place increased pressure on local services such as bylaw enforcement, fire safety, and waste collection. Without additional funding, municipalities struggle to support this expansion while ensuring safe and sustainable communities.

“It’s great that Brampton, Ontario’s third-largest city, has joined over 100 municipalities, from large to small, in calling for sustainable funding for critical infrastructure. Municipalities need predictable resources without burdening residents with higher property taxes. Redistributing the Land Transfer Tax and GST on new home sales is a fair way to give municipalities the tools they need to support growth and keep communities running smoothly—no new taxes, just a fair share.”

– Mayor Tom Mrakas, Town of Aurora

The motion urges the Province of Ontario to redirect a portion of the LTT to municipalities and calls on the federal government to allocate a percentage of the GST from property sales to local governments. This redistribution would provide a predictable and sustainable funding source, allowing municipalities to better plan long-term investments in critical infrastructure.

Brampton’s request aligns with advocacy efforts from over 100 municipalities across Ontario. The resolution will be forwarded to the key ministers, opposition leaders, and local MPs and MPPs. It will also be shared with the Region of Peel Council, the Federation of Canadian Municipalities (FCM), and the Association of Municipalities of Ontario (AMO) for endorsement and further advocacy.

By pushing for a fair share of tax revenues, Brampton aims to secure the resources needed to support its rapid growth, ensuring safe housing, strong infrastructure, and sustainable city services for residents.