Thank You for Participating

Thank you to the many residents who attended the Budget 2026 Coffee Chat for Wards 1 and 5 at Century Gardens. Thank you also to local businesses: Jamie’s Cracked Corn, Occassions Treats, and Segovia Coffee for providing delicious refreshments.

These annual budget sessions which are hosted by the Mayor and local Councillors are designed for informal questions and feedback from residents on the proposed budget.

Below is a consolidated summary of the most common questions raised at the Budget Chat. Click here for the specific details about the proposed Budget 2026 released on Friday, January 9th.

What is the overall focus of the 2026 City of Brampton budget?

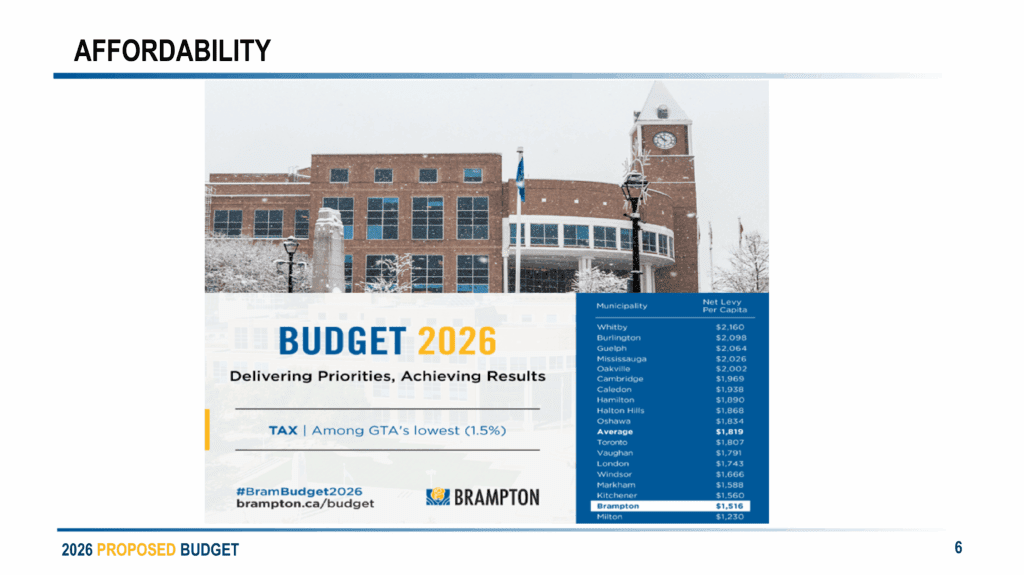

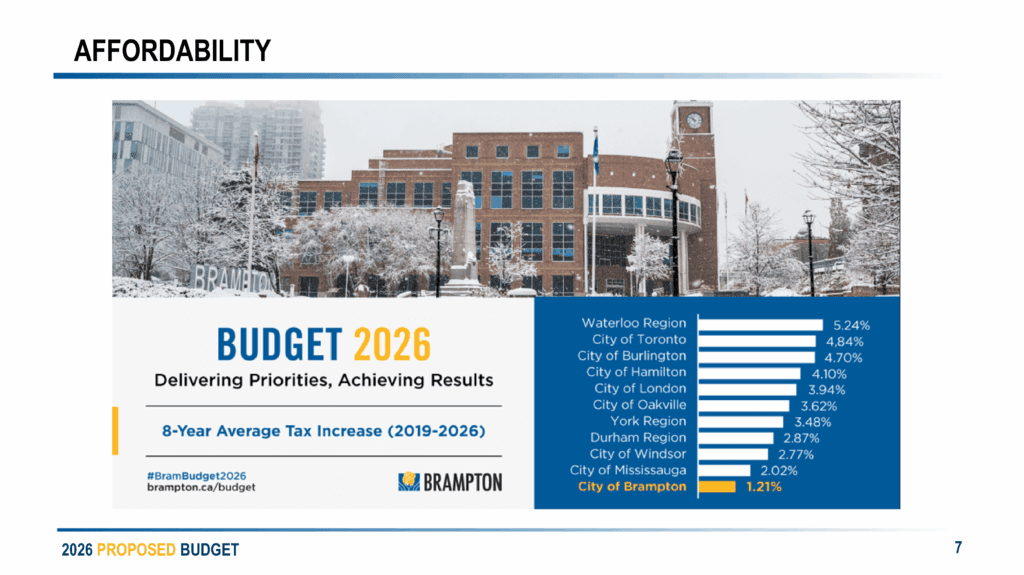

The proposed 2026 budget prioritizes affordability, health and safety. It is designed to strike a careful balance between maintaining essential City services and addressing affordability pressures facing residents. The City focused on funding what is absolutely necessary, such as public safety, healthcare, recreation, and bylaw enforcement, while delaying or scaling back projects that are not critical at this time. Through significant internal efficiencies, the City limited the local property tax increase to 1.5%, of which operating costs only increased by 0.8% despite pressures of inflation and increased labour costs, keeping Brampton among the most affordable municipalities in the GTA.

Why is the City continuing to invest in recreation facilities?

Recreation is considered a long-term investment in community health and well-being. Access to recreation centres, sports facilities, and programs including arts programs, helps keep residents active, supports youth development, and reduces pressure on the healthcare system. The City continues to fund new and expanded recreation centres, outdoor amenities, and free recreation for seniors, recognizing that these services improve quality of life and support healthier, more connected neighbourhoods. I am excited about the opening of the Century Gardens Youth Hub and fully renovated Chris Gibson Recreation Centre this year, among other amenities across the entire city.

Why is there a healthcare levy on property taxes?

The healthcare levy funds Brampton’s required and local contribution toward the new second hospital, including infrastructure costs and medical equipment. It represents 1% of the property tax bill. While the Province builds and operates hospitals, municipalities are still required by legislation to contribute a portion of the capital cost (building and equipment). The levy ensures Brampton remains ready and eligible for this critical healthcare investment, which will help relieve chronic overcrowding at existing hospitals and meet the needs of a growing population.

How is the City responding to affordability challenges facing residents?

The City recognizes that many residents are dealing with rising costs, job uncertainty, and economic pressures. It is a tough time for everyone. In response, Council directed staff to prioritize essential services, defer non-critical projects, and find savings within existing operations. Every department was required to identify efficiencies, reduce discretionary spending, and justify costs. These steps over the past 7 years have helped minimize the impact on taxpayers while continuing to deliver core services residents rely on.

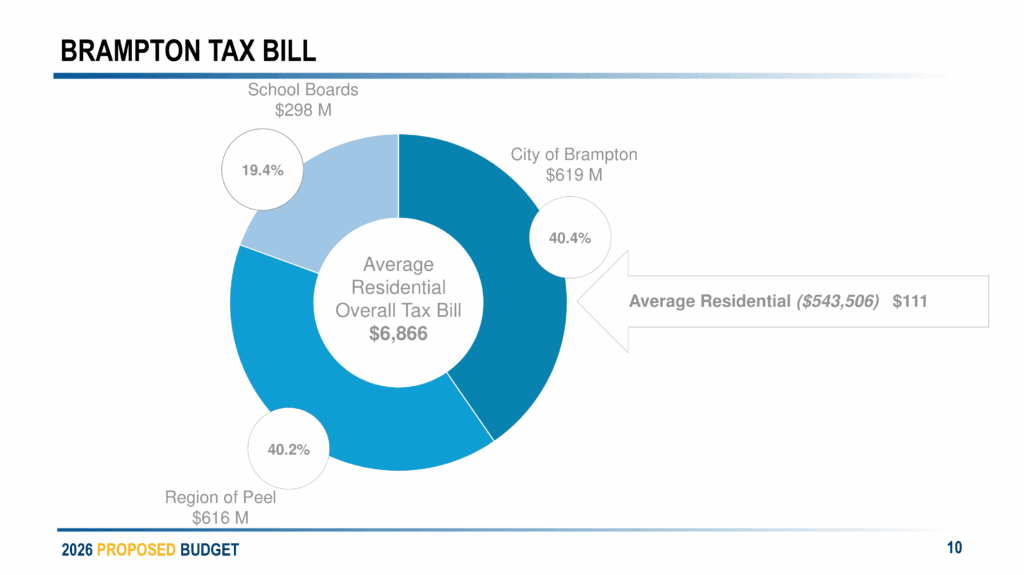

How is my property tax bill divided, and what does the City control?

A typical property tax bill is divided among several levels of service. Approximately 20% goes to school boards and is set by the Province. Around 40% goes to the Region of Peel, which funds services like policing, paramedics, public health, and waste management. The remaining 40% funds City services such as roads, parks, recreation, bylaw enforcement, and fire services. The City budget discussions focus only on this City-controlled portion.

Why doesn’t Brampton offer windrow (driveway snow pile) removal?

Windrow snow removal would significantly increase the overall cost of winter maintenance, nearly doubling snow removal expenses. In addition, the service cannot be provided on many narrow streets, courts, and crescents, meaning not all residents would benefit equally. Public consultations showed that most residents did not support the added cost. Instead, the City offers rebates for seniors and residents with disabilities who hire snow clearing services and continues to review snow operations for efficiency and fairness.

What is the City doing about illegal rental units and unsafe housing?

The City has expanded its Residential Rental Licensing program across Brampton to address unsafe and overcrowded rental units. The program allows the City to inspect rental properties, enforce fire and building safety standards, and take action against landlords who put tenants and neighbourhoods at risk. Penalties increase for repeat offenders, and fines collected are reinvested into enforcement. This approach aims to protect tenants, improve neighbourhood conditions, and hold irresponsible landlords accountable.

Is bylaw enforcement becoming more proactive?

Yes. The City is shifting from a complaint-only model toward more proactive enforcement. Investments include new technology such as license plate readers, increased staffing, higher fines for repeat offenders, and better data tracking. Improvements to the 311 system are also underway to provide clearer updates to residents and ensure service requests are followed through more effectively. Update on bylaw enforcement improvements.

What is happening with transit and the LRT project?

Brampton’s underground LRT project is fully funded by provincial and federal governments and represents a major long-term investment in transit and economic growth. While transit ridership experienced a temporary dip due to external factors, the City continues to plan for future growth, adjust routes as needed, and invest in a transit system that supports residents, workers, and students over the long term.

How is the City controlling internal costs and spending?

Cost control is an ongoing, year-round process. The City reviews thousands of budget line items and hundreds of capital projects annually. Departments are given efficiency targets and must demonstrate how they are reducing costs or improving service delivery. These internal controls have helped Brampton lower its relative tax burden compared to other GTA cities while maintaining service levels.

What steps are being taken to improve public safety and traffic enforcement?

The City continues to work with regional partners to improve police coverage and response times. Locally, investments are being made in traffic enforcement, parking enforcement, and bylaw compliance through new technology and additional staff. Traffic cameras are being repurposed for red-light enforcement and investigations, and new tools are being explored to improve enforcement during snow clearing and other operations.

How can residents participate and have their voices heard in the budget process?

Residents are encouraged to attend budget coffee chats, participate in town halls and surveys, and share both spending ideas and potential savings. Engagement at the local level helps Council understand community priorities. Residents are also encouraged to advocate to provincial representatives to ensure Brampton receives its fair share of funding for healthcare, transit, and social services.

Have Your Say and Stay Connected

Residents are encouraged to share feedback, questions, and suggestions by completing the Budget 2026 Feedback Form below:

Click here to provide your Feedback.

All submissions before the cut off date would be reviewed and help inform ongoing budget discussions and advocacy.

Additional Public Engagement Opportunities for Budget 2026

Council Meetings

Council will be holding special meetings to discuss the 2026 Budget on these dates:

- Monday, January 19, 2026 – 10:00 AM to 2:00 PM

- Tuesday, January 20, 2026 – 10:00 AM to 1:00 PM

- Friday, January 23, 2026 – 9:00 AM to 12:00 PM

Tentative Budget Approval:

- Tuesday, January 27, 2026 – 12:00 PM to 3:00 PM

- Friday, January 30, 2026 – 9:00 AM to 1:00 PM (if needed)

Location: All meeting sessions will be held in the Council Chambers, 4th Floor, City Hall (2 Wellington St West) or residents can watch the sessions virtually.